Jul 10, 2023

A new tool in the fight against fraud

Fraud costs the health care system billions of dollars each year.

“It’s an astronomical figure, accounting for about 3-10 % of health care spending each year,” said Jennifer Stewart, senior director for fraud investigation and prevention at Blue Cross Blue Shield of Massachusetts.

“The majority of fraud cases are schemes perpetrated by highly sophisticated organizations, not hospitals or physicians who may make a billing error or two,” Stewart said. “For example, criminal organizations may buy health data on the dark web, pose as clinicians, and then submit fake health insurance claims using the data.”

Those fraudulent claims contribute to the rising cost of health care for employers and employees. To protect their customers and members, health plans are cracking down on bad actors in several ways, Stewart said.

“Every dollar we save through our efforts to detect fraud, waste and abuse is a dollar we can use to pay for legitimate medical care for our members,” notes Blue Cross SVP and General Counsel Don Savery.

An innovative approach

Blue Cross, the state’s largest not-for-profit health plan, is putting its artificial intelligence capabilities to work to stop criminal networks in their tracks – saving customers and members millions of dollars in the process.

“Working with our fraud team, we developed an algorithm that combs through large volumes of data — including known fraud schemes and other public data sources — and flags suspicious billing practices the team can review before we pay the claim,” said Blue Cross' Chief Data & Analytics Officer Himanshu Arora.

What would take the team weeks to do manually, the algorithm can complete in a day

says Himanshu Arora.

Blue Cross has long had a robust program to detect known schemes and reclaim money from providers who commit fraud after it pays them. But importantly, “these new tools help us identify schemes before we pay for services,” Stewart said.

To date, Stewart noted, 65-70% of the algorithm’s leads have turned out to be confirmed cases of potential fraud and abuse. That percentage will improve as the model learns and strengthens its processes, Arora said.

“This work is a great example of how data and analytics can help us make health care more affordable for our members, both through the dollars we save by not paying fraudulent and abusive providers and because the model helps our company operate more nimbly and efficiently,” Arora said.

This isn’t the first time Blue Cross has used AI to help members, Arora noted. During the pandemic, his team developed an algorithm to identify members at the highest risk for developing a serious health condition should they get COVID-19. A team of Blue Cross nurse case managers then reached out to these members and provided them with education and support.

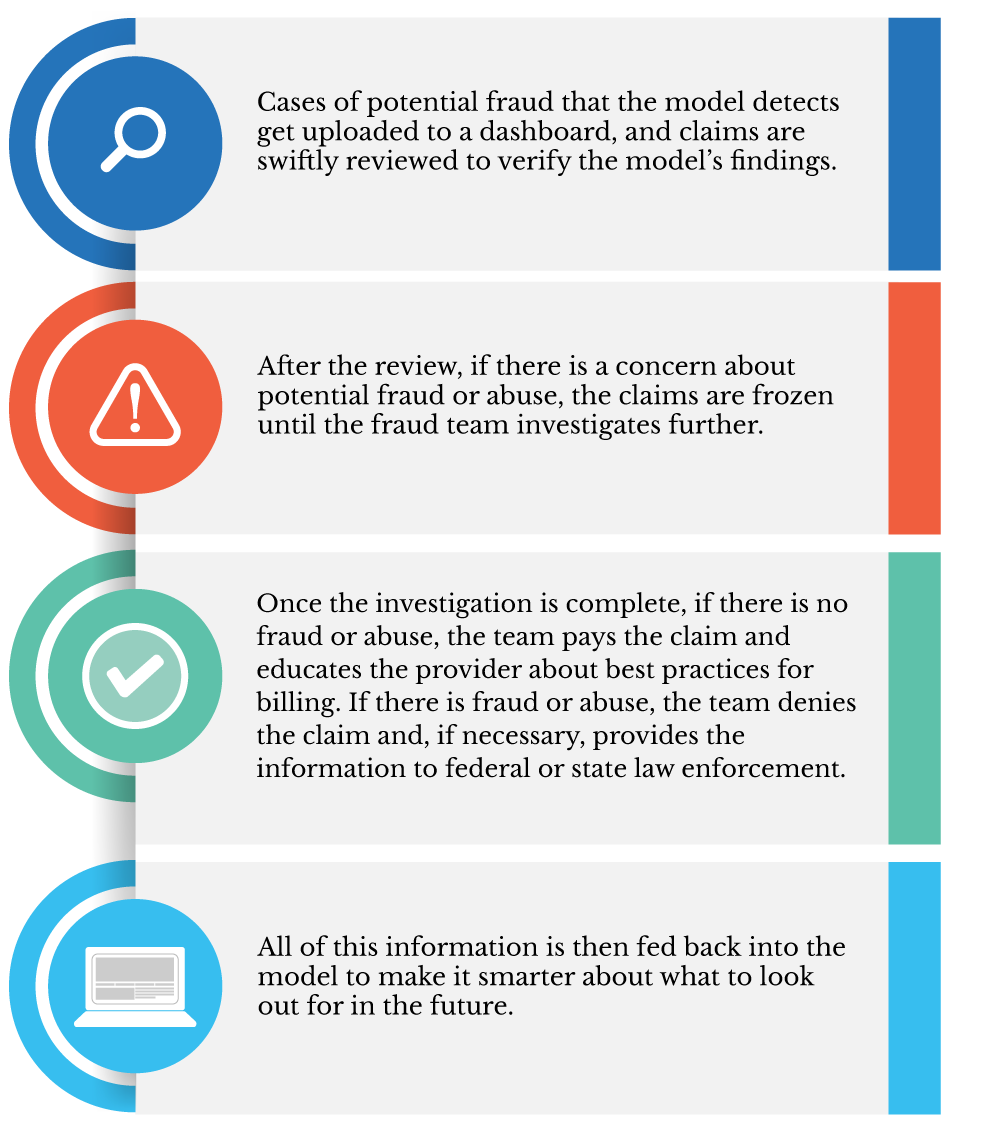

How the fraud algorithm works

Arora said his team will continue to fine-tune the model. “Moving forward, we will further enhance the model and share knowledge with our sister Blue plans so we can continue to root out fraud and abuse from the system and save our members and accounts money.”

Did you find this article informative?

All Coverage content can be reprinted for free.

Read more here.